Tokenomics

The Pendulum/Amplitude tokenomics in a nutshell

PEN will be the native token on Pendulum (Polkadot parachain). AMPE is the native token of Amplitude (Kusama parachain).

Pendulum Tokenomics Overview

PEN will be the native token of Pendulum. PEN utilities include powering transactions as the gas token on Pendulum as well as governance and staking.

Tokenomics Overview

Ticker: PEN

Relay Chain: Polkadot

Supply Structure: Inflationary, through staking and vault operator rewards

Supply at Genesis: 160,000,000

Max Supply: 200,000,000

Initial Circulating Supply: 10,000,000

Total Supply: see here

Circulating Supply: see here

Consensus: Limited Delegator Proof of Stake

Token Usage: Gas,Staking and Governance

Distribution

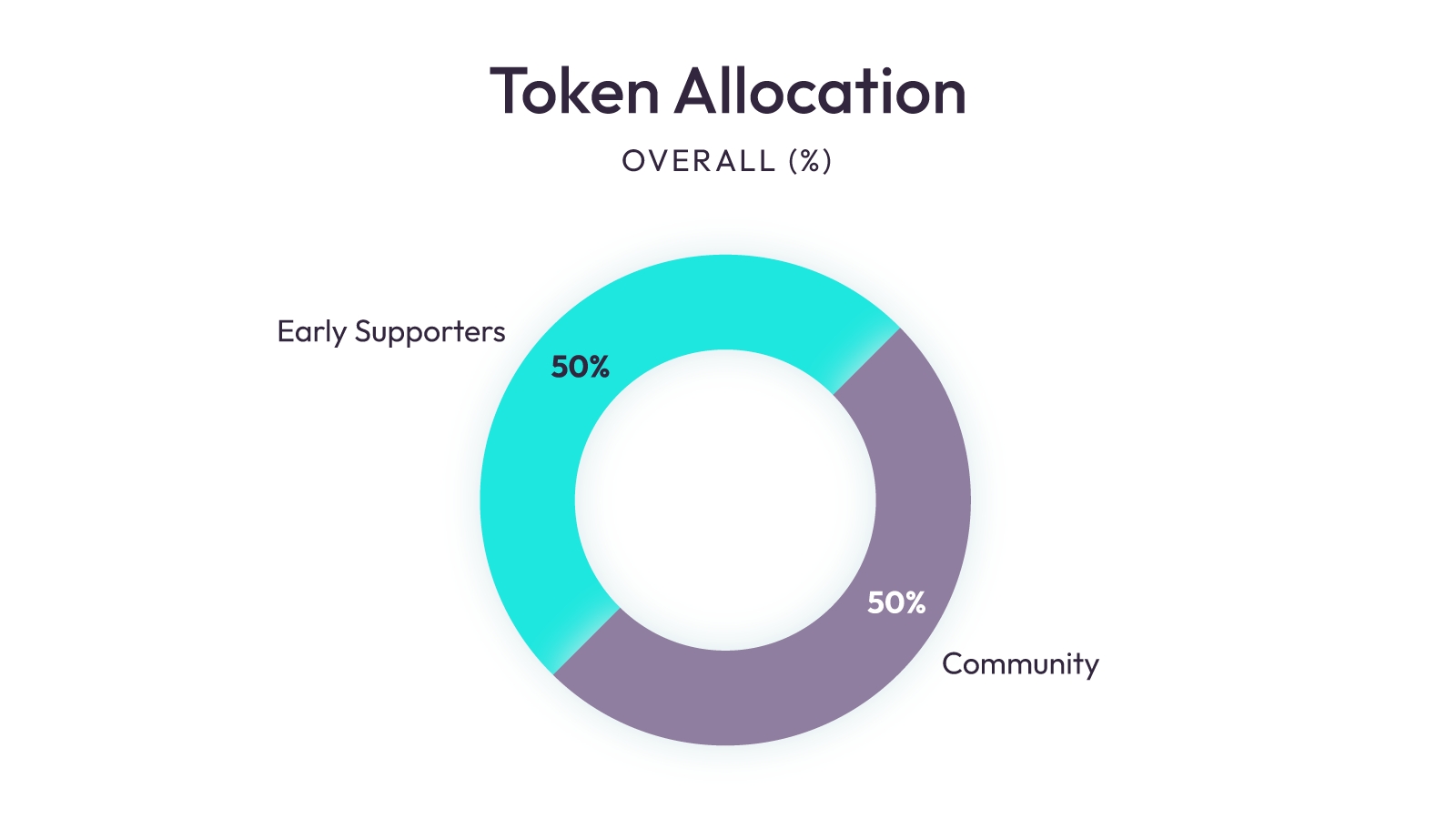

The distribution maintains a balance between Pendulum’s early supporters and the Pendulum community with an even 50/50 split.

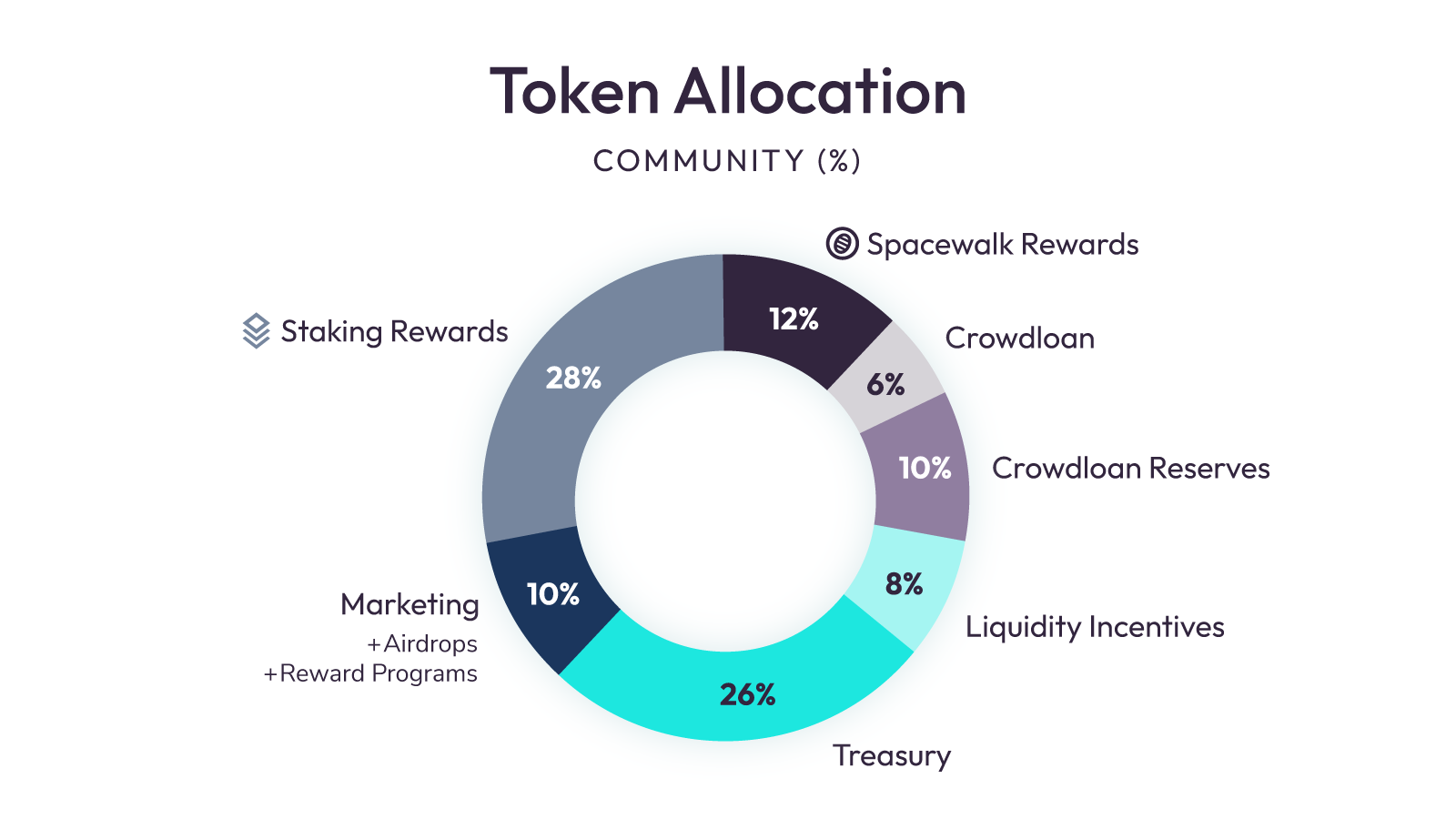

Community Distribution

The chart below shows the percentage that each community bucket takes up from the community bucket that takes up 50% of the total PEN total allocation. The community distribution includes staking rewards for directly staking PEN (28%) as well as staking rewards related to Spacewalk bridge (12%). The Crowdloan #35 was won by Pendulum

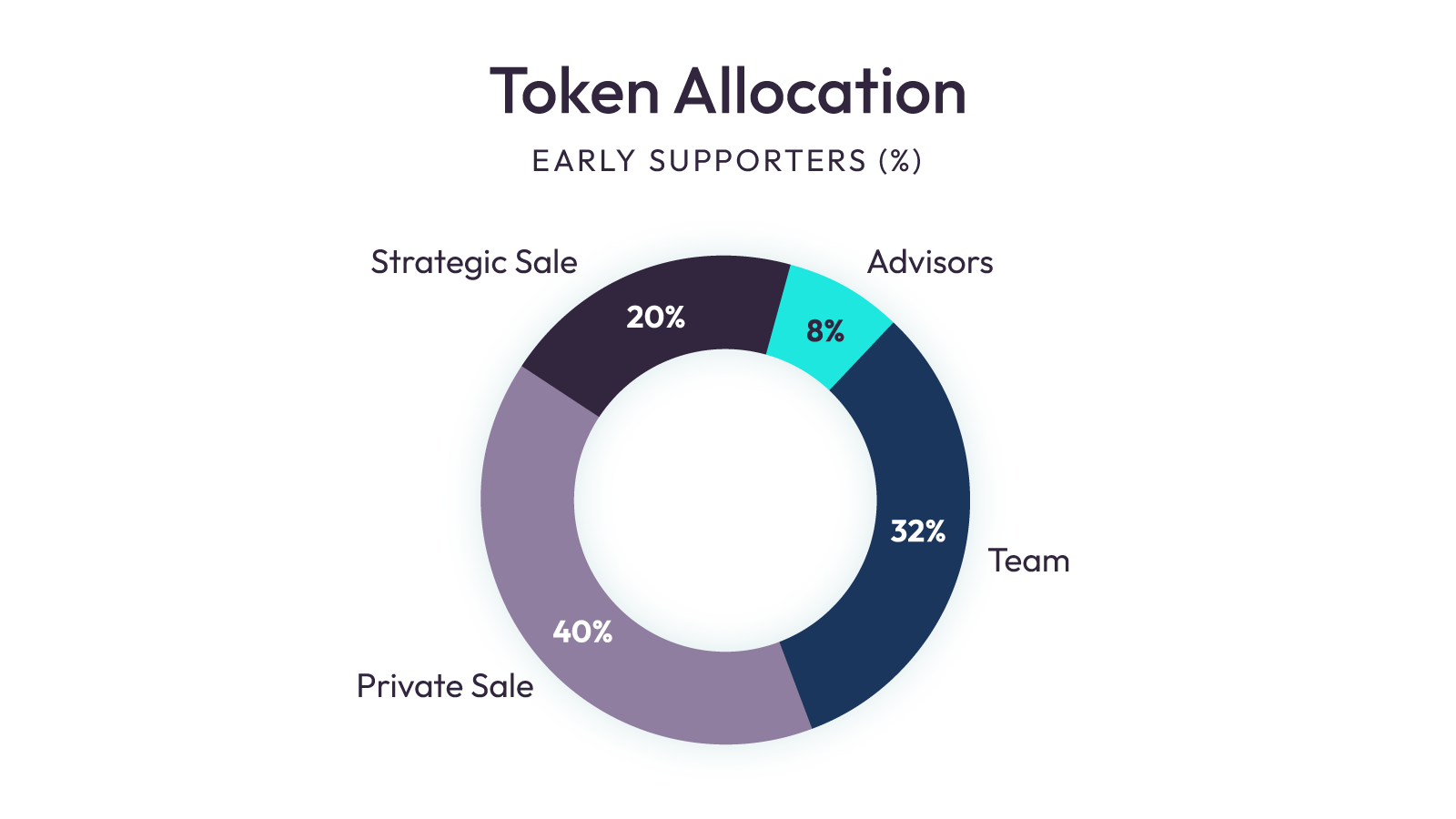

Backers Distribution

The below chart shows the distribution of tokens to Pendulum’s early backers that have supported the building of Pendulum and Amplitude for over 1 year now.

Note: The percentages in the Community and Backers charts should be halved to find the percentage of the overall tokenomics. For example, Staking Rewards is 14% of the overall tokenomics and 28% of the Community bucket.

Vesting Schedule Below is the vesting schedule for all community and backer tokens. Most of the tokens include a vesting schedule that unlocks linearly over 2 to 3 years to ensure all participants are incentivized to work towards Pendulum’s long-term growth.

| Allocation | Distribution (%) | TGE Unlock (%) | Vesting (months) | Cliff (months) |

|---|---|---|---|---|

Private Presale | 20 | 2.0 | 24 | - |

Polkadot Parachain Crowdloan | 3 | 0.3 | 22 | - |

Strategic Presale | 10 | 10 | 24 | - |

Exchange Listing | - | - | - | - |

Treasury | 13 | 3.9 | 60 | - |

Marketing | 5 | 0.5 | 36 | - |

Rewards | 20 | Perpetual | - | |

Crowdloan Reserve | 5 | 0 | 22 | - |

Liquidity | 4 | 0 | 24 | - |

Team/Advisors | 20 | 0 | 18-36 | 6-12 |

Definitions:

Advisors: Allocation for backers with specific expertise supporting Pendulum with their advisory services

Team: Allocation for current and future team

Private Sale: Allocated tokens for the private sale investors

Strategic Sale: Allocated tokens for the strategic sale investors

Crowdloan: Allocation for rewarding participants who help us in winning the parachain auction. Remaining funds from this will be added to the treasury.

Crowdloan Reserve: Allocated to fund future parachain actions

Liquidity incentives: Allocated for providing initial liquidity on exchanges and liquidity provisioning rewards

Treasury: Allocated to the Pendulum network treasury required to fund product development and enhancements

Marketing: Allocated for marketing campaigns, airdrops, partnerships and events

Staking rewards: Allocated for consensus staking related rewards

Spacewalk rewards: Allocated for rewards related to Spacewalk

AMPE Tokenomics Overview

Ticker: AMPE

Relay Chain: Kusama

Supply Structure: Fixed

Max Supply: 200,000,000

Total Supply: see here

Circulating Supply: see here

Initial Circulating Supply: 11,555,556

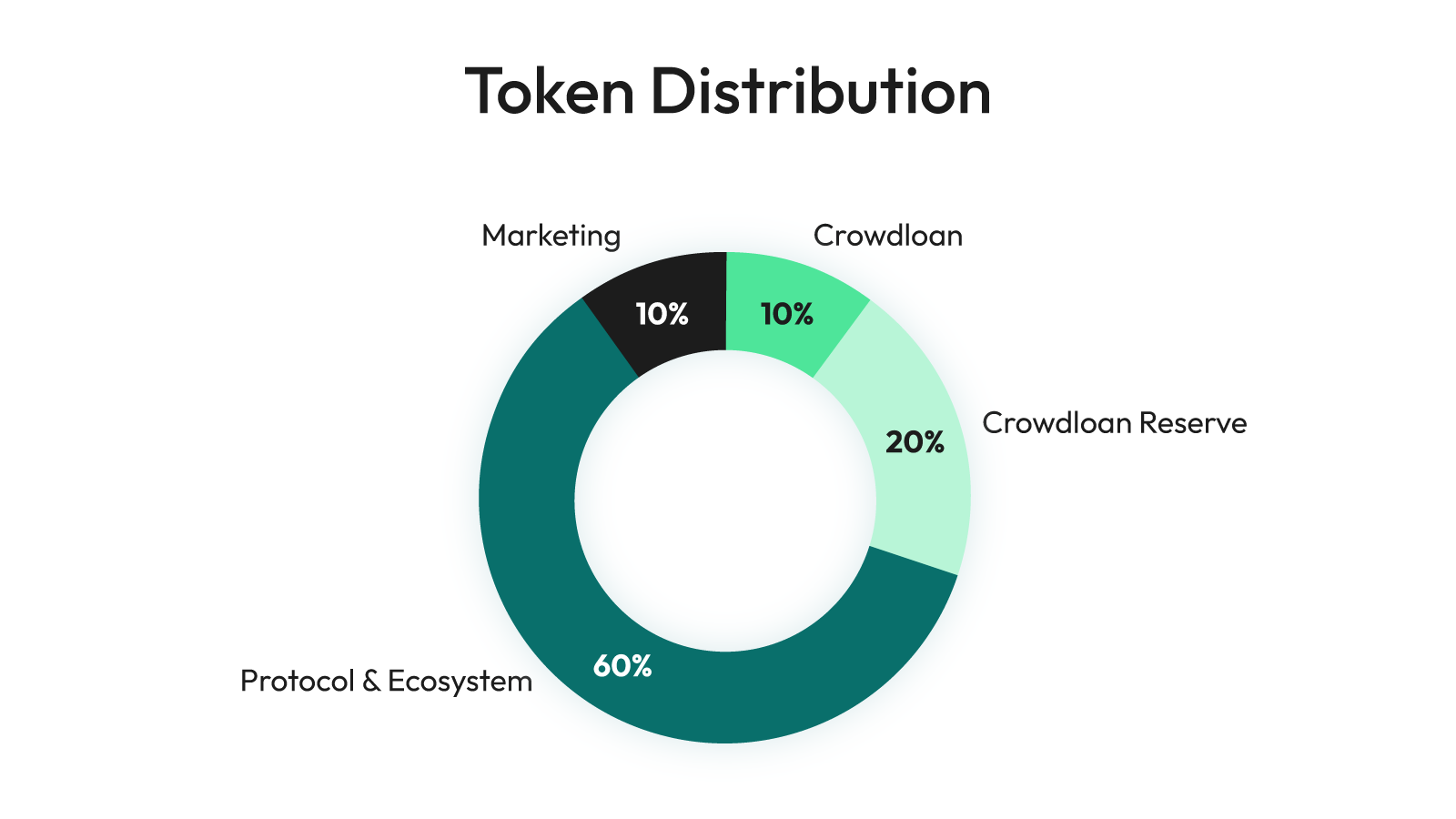

Distribution

In order to ensure Amplitude is a community-first project, the Pendulum team decided to take no allocation of AMPE tokens for themselves or advisors and held no token private sales.

The distribution is reflective of the intended nature of the project that truly gives Amplitude to the community.

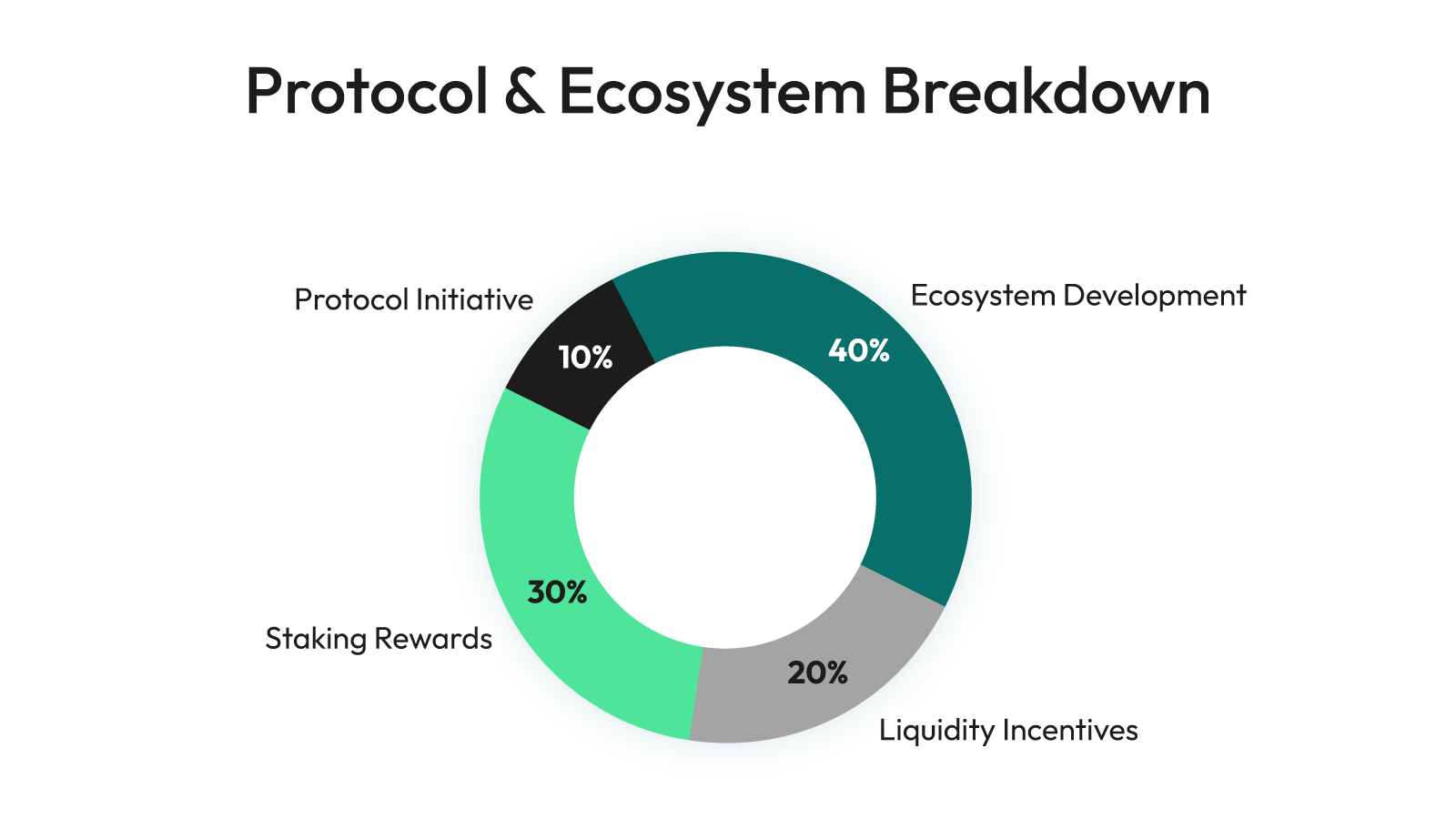

Protocol & Ecosystem Breakdown:

AMPE Token Utility

Amplitude will be the canary network of its sister blockchain, Pendulum. It will act as a testing ground for applications and network parameters for Pendulum, but with real financial consequences.

AMPE token utilities will initially include transaction fees, staking and on-chain governance. Transaction fees will be an integral part of using the network and will be applicable when making any transactions on the protocol and will be paid using AMPE. The fee will be split between the community treasury, rewards and others.

On-chain governance will follow a quadratic voting mechanism to ensure more votes for smaller holders and to disincentivize a single holder casting multiple votes on a single proposal. Proposals in the following categories can be voted on by the community of token holders:

1. Asset Usage — Proposals to use the Asset, such as listing and delisting the token on DEXes and CEXes.

2. Reward Distributions — The mechanism and amount of rewards distributed to different players of the network.

3. Parameter Modifications — Technical upgrades, smart contract configuration changes, transaction fees, etc.

4. Community Proposals — Other suggestions / recommendations from the community.

The objective of these tokenomics is to set up a fertile ground for a community-driven chain where experimentation can blossom. For more details on the Amplitude crowdloan participation and bonuses please visit our FAQs page.

Last updated